How It Works

Eliminate your currency risk

How does FXWELLS work?

The Problem

Many businesses operate on average net profit margin of 8% to 10%.

Many businesses operate on average net profit margin of 8% to 10%.

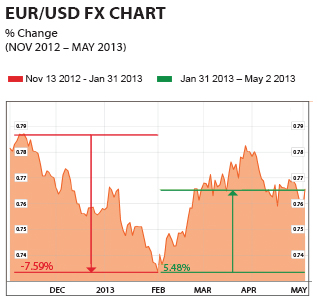

If your supplier gives you 90 days to pay, whether you know it or not you have 90 days where the foreign exchange rate can move against you.

For example if the exchange rate moves by 7.59 % that could wipe out all the profits on your transactions.

The Solution:

FXWells helps you get protection on 18 currencies for the amount of your choice to completely remove the currency risk.

It works like a firewall for you. You pay a small fee and where ever the price of your currency is at the end of the waiting period, you will be fully protected in both directions.

Example

Let us suppose that Machine, Inc. has sold machine tools worth EUR 500,000 to a customer in Germany, with a 3-month deadline for payment.

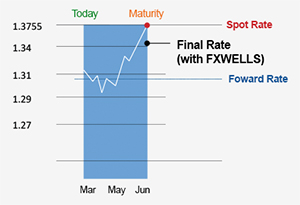

Scenario A

Scenario A

At maturity, the spot rate has risen to 1.3755 (+5% change):

The treasurer sells the EUR at 1.3755, has to factor in a hedging fee of 2.5% and achieves an end rate of 1.3411.

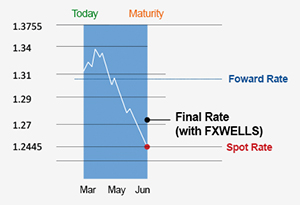

Scenario B

Scenario B

At maturity, the spot rate has fallen to 1.2445 (-5% change):

The treasurer exercises agreement with FXWELLS at 1.3100, has to factor in a hedging fee of 2.5% and achieves an end rate of 1.27725. This is the lowest possible rate with this kind of hedging (worst-case scenario).

FXWELLS will calculate the value of the position and pay FX loss to Machine, Inc..

Conclusion

Hedging with FXWELLS makes perfect sense if an advantageous rate movement (scenario A) is expected. In the worst-case (scenario B), Machine, Inc. still hedges at a minimum rate with the loss limited to the hedging fees (2.5%), compared to full 5% loss without any hedge.